Despite Revolut’s fast growth and addition of new features, many app users only need some of them. Therefore, many apps may be an excellent alternative to the well-known Revolut.

However, it will be very challenging if you’re looking for a complete replacement with the same features because you may need to compromise and pick multiple alternatives simultaneously.

It’s best to understand what services you mostly require and pick an app similar to Revolut. To make it easier, we’ve combined a few lists with the best alternatives to Revolut based on features.

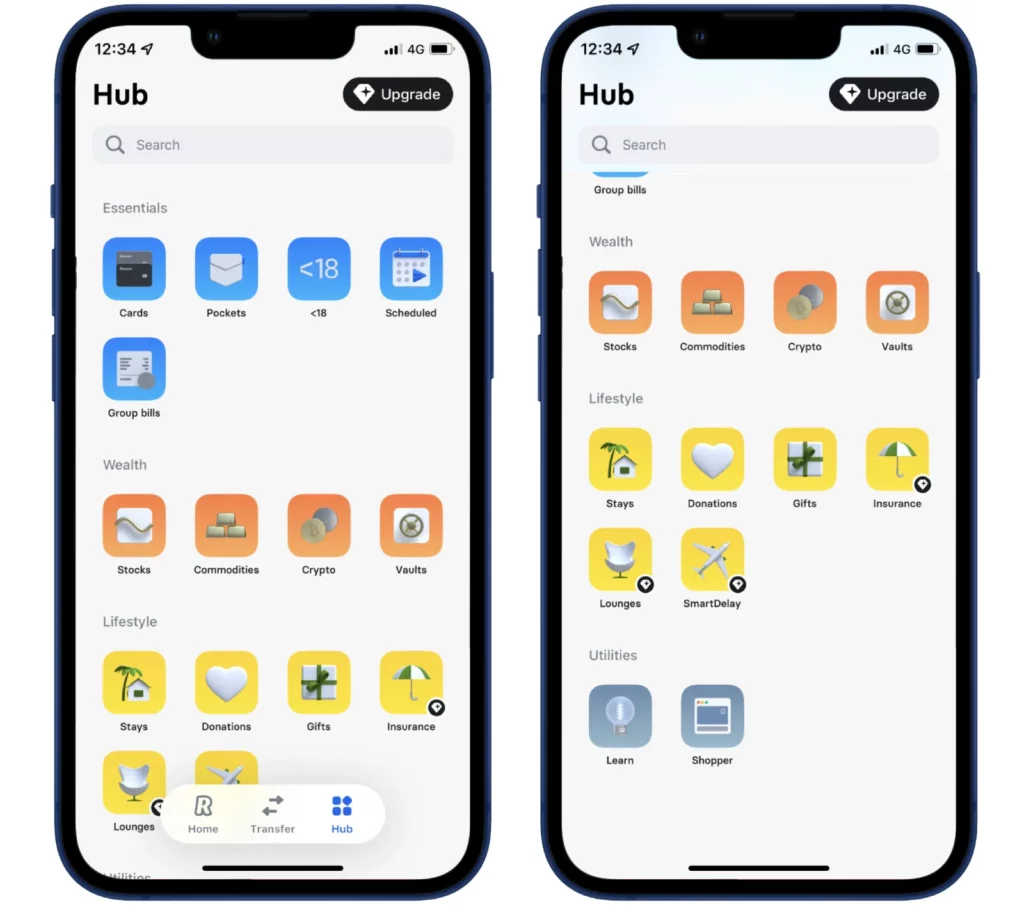

These are all the services and features currently offered by Revolut:

Best alternatives to Revolut by features

We’ve analyzed the best alternatives to Revolut according to the app’s main features. See the main sections below and find the best Revolut alternative for money transfers, stock trading, cryptocurrencies, and business.

Revolut money transfer alternative

Alternatives to Revolut Trading

Your capital is at risk.

See the Trading 212 promotion worth up to 100 EUR

*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

Revolut card alternatives

If you use Revolut as a bank or for payments (local or international), there are quite a few alternatives, as enough companies offer such services.

WISE – Online money transfers

Wise (Formerly TransferWise) is one of the best alternatives to Revolut. The app offers the best rates for international payments. It’s used by more than 11 million customers; it’s FCA regulated and available in most countries.

If you don’t need other features that Revolut can offer, this could be the best service like Revolut.

Revolut cryptocurrency alternatives

Today, most people have already heard about cryptocurrencies. Many have started to learn about them. But only some decide to take advantage of the growing market by investing in the crypto market.

Revolut introduced cryptocurrency trading a few years ago. However, it hasn’t changed much, and there are still many limitations regarding various features that crypto traders may want. Hence why, traders often decide to trade cryptocurrencies on other platforms. Some popular platforms for buying or trading cryptocurrencies can be seen below.

eToro as an alternative for crypto trading

eToro is a company that is growing very fast. That also reflects in crypto trading as new coins and features appear on the platform. It has a stable platform with a social trading element where you can discuss your trading ideas with other traders.

If you want to buy cryptocurrencies, eToro is a cheaper platform than Revolut. I.e. If you’re buying Bitcoin worth 2,000 EUR, you may save around 35 EUR in buying fees compared to Revolut. And a similar amount when selling – depending on the cryptocurrency price. More about that you can read in our Revolut cryptocurrency review.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

Not only cryptocurrency traders but also stock traders are often choosing between eToro and Revolut. eToro is one of the most popular Revolut trading alternatives in Europe. It’s easy to understand and is well-suited for both; beginners and experienced traders.

eToro benefits

- The leading social trading platform in the world with a user base of 20 million traders.

- A simple fee structure.

- A regulated trading platform in the U.K. and Europe.

- Diversified asset classes for investors to choose from.

- A tremendous user base growth in the last few years.

- Patented technology protects the business from being copied.

- Feature-rich and the user-friendly trading platform even for beginners.

- The low entry barrier for new traders.

Revolut Trading alternatives

Revolut Trading Limited is currently registered and regulated in the UK. Because of this, many non-UK traders are looking for Revolut trading alternatives for additional funds protection that the EEA deposit protection scheme would cover.

It doesn’t necessarily mean that Revolut trading is a complete no-go, but there are additional risks that you could avoid by choosing a broker that is regulated in the EU. Revolut can’t advertise its trading services and provide trading support in the EU. If you decide to continue investing through the app, the whole responsibility relies on you.

If you’re from the UK, it’s not an issue for you, but there are also other reasons why traders and investors consider switching to a different trading platform:

- Changes in the fee structure.

- The stock trading service is down from time to time. Traders may be unable to sell or buy stocks at a desirable time and price.

- Day trading limits.

- Changes to limits for free day trades.

- Stock trading limits (Up to 10,000 USD or 500 shares per order).

- Revolut trading doesn’t hold your shares. It’s a broker buying and selling stocks on your behalf.

- Limited Revolut stocks list available for trading.

- Etc. (If you have other reasons, feel free to share them in the comments section.)

You will probably find a better alternative with more features and fewer fees. We have compiled a list of traders’ most popular alternatives to replace Revolut stocks with an alternative regulated in the European Union.

DEGIRO vs Revolut

DEGIRO is a Dutch trading platform established in 2013 and quickly became one of the largest brokers in Europe. It is a regulated broker, and you may expect low commissions, a simple platform and a large selection of stocks.

Compared with Revolut, DEGIRO traders can invest in multiple markets, i.e. Europe, the US, Australia, Japan, and Hong Kong. A great option to diversify your portfolio with a global approach.

| DEGIRO | Revolut | |

|---|---|---|

| Most suitable for | Beginners & Experienced traders | Beginners |

| Min. deposit | 0.01 EUR | 0.01 USD |

| Min. order value (Stocks) | No minimum | 1 USD |

| Min. withdrawal amount | No minimum | No minimum |

| Demo account | Not available | Not available |

| US stock trading fee (Buy/Sell) | 0.00 EUR on US Exchanges, and 0,1% Auto FX. | 0 USD (Limited) |

| Deposit fee | 0 EUR | 0 USD |

| Withdrawal fee | 0 EUR | 0 USD |

| Regulation | Regulated in the UK (by FCA) and EU (by AFM). | Regulated in the UK (by FCA). |

Trading 212 vs Revolut

Many traders trade stocks using the Interactive Brokers platform, which may be difficult for less-experienced traders. Besides, it requires substantial starting capital. This is where Trading 212 comes in.

Trading 212 uses the same IBKR platform but is better suited for less-experienced traders. Trading 212 is very similar to Revolut trading but offers a much more comprehensive selection of stocks and other tools that may help you analyze the markets.

| Trading 212 | Revolut | |

|---|---|---|

| Most suitable for | Beginners | Beginners |

| Min. deposit | 1 USD/EUR/GBP | 0.01 USD |

| Min. order value (Stocks) | 1 USD/EUR/GBP | 1 USD |

| Min. withdrawal amount | 1 USD/EUR/GBP | No minimum |

| Demo account | Available Your capital is at risk. | Not available |

| US stock trading fee (Buy/Sell) | 0 USD/EUR/GBP | 0 USD (Limited) |

| Deposit fee | 0 USD/EUR/GBP | 0 USD |

| Withdrawal fee | 0 USD/EUR/GBP | 0 USD |

| Regulation | Regulated in the UK (by FCA) and EU (FSC). | Regulated in the UK (by FCA). |

| Try Trading 212 Your capital is at risk. |

Plus500 vs Revolut

Plus500 is one of the oldest companies among the ones mentioned above. The company was founded in 2008 in Israel. Plus500 is very competitive in terms of fees and is one of the top CFD providers. The platform’s financial instruments (I.e. CFDs) are most suitable for experienced traders.

| Plus500 | Revolut | |

|---|---|---|

| Most suitable for | Experienced traders | Beginners |

| Min. deposit | 100 USD | 0.01 USD |

| Min. order value (Stocks) | – | 1 USD |

| Min. withdrawal amount | Depends on the trader’s country of residence and payment method of choice. | No minimum |

| Demo account | Available 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. | Not available |

| US stock trading fee (Buy/Sell) | 0 USD | 0 USD (Limited) |

| Deposit fee | 0 USD | 0 USD |

| Withdrawal fee | 0 USD | 0 USD |

| Other fees and charges may apply. More information at Plus500. | ||

| Regulation | Regulated in the UK (by FCA), EU (by CySEC #250/14), Estonia EFSA (Licence No. 4.1-1/18), Australia (by ASIC), Singapore (by MAS) and Israel (by ISA). | Regulated in the UK (by FCA). |

| Try Plus500 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

Revolut Business alternatives

PayPal has been around for years. Even before most of the apps we use today. It has competitive prices and easy-to-implement payment systems, as most platforms have created plugins and technical solutions to integrate with PayPal.

PayPal

Common reasons why users choose to close Revolut account

There may be many reasons why people look for alternatives to Revolut, but some of the most popular are:

- Revolut closed an account or limited features.

- Automated or slow live support.

- Particular countries are not supported.

- Stock traders outside the UK are no longer protected by EU law.

- Changes in the fee structure.

- The app is not yet fully stable, and services are down occasionally.

- A small cryptocurrency list for crypto traders.

- Cryptocurrency transfer limits.

- Etc. (If you have other reasons, feel free to share them in the comments section.)

These are only a few examples, and you probably have your own reason to look in the direction of Revolut’s competitors. Revolut has created a multipurpose financial app that’s not limited to residents of one particular country. Many similar or even better apps than Revolut may be limited to residents of one country.

Frequently asked questions about Revolut alternatives.

It depends on how you’re using the Revolut app. Trading 212 is a good alternative to Revolut for stock trading, eToro for cryptocurrencies and Wise for international money transfers.

There’s no clear answer to this question. It comes down to features that you’re mainly using. Revolut offers a broader range of features, but Wise (Transferwise) offers better international payment handling. Compare these apps with alternatives to Revolut to find out more.

Revolut offers multiple services on the app. Since not many apps can offer the same package of features, you may find a better app depending on your particular needs. I.e. Check Revolut alternatives by category and pick the one that fits your criteria.

If you don’t have an account with Revolut, you can create one for free and test the app to find if it’s useful for you.

The most popular app equivalent to Revolut is the Robinhood app. The Robinhood app was developed earlier than Revolut and has taken the leading position in the US market.

Thanks Martin, very useful. I have both Revolut account for normal day to day and a eToro account which I use for ETF’s. Was only considering Revolut for individual stocks in view of an amount of commission-free trades based on my Premium account so your review is very helpful.