You may have heard that the crypto market is driven by fear or greed. So the crypto fear and greed index measures those emotions in the market using data from various sources. But what does that mean, how can you use it to your advantage, and what’s the Bitcoin fear and greed index today? In this article, you’ll learn all of that and more.

What is Crypto Fear And Greed Index?

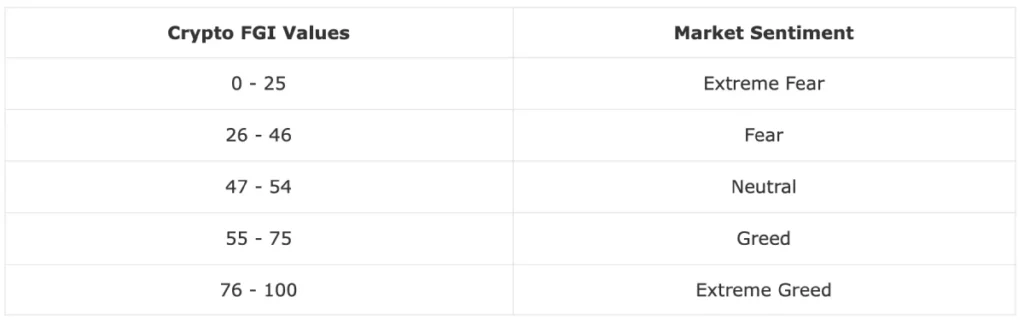

The crypto fear and greed index is a valuable cryptocurrency market sentiment tool to identify fear or greed level in crypto and Bitcoin investors. Understanding where the market lies on this index enables you to make more informed decisions about when to buy or sell cryptocurrencies. The index mostly tracks Bitcoin since it’s the most popular cryptocurrency. You can find what the BTC fear and greed index is today below.

The index is used as a financial strategy to time the market by understanding how investor emotions influence their decisions regarding crypto investment. CNN Money initially developed the Fear and Greed Index (FGI) as a general market-timing tool to know how investor emotions influence stock market investment decisions. However, the Fear and Greed Index has found its way into the cryptocurrency market as a critical component that helps determine whether it’s bullish or bearish. The term was coined to help investors avoid emotional overreactions when investing in cryptocurrency.

Bitcoin Fear and Greed Index Today

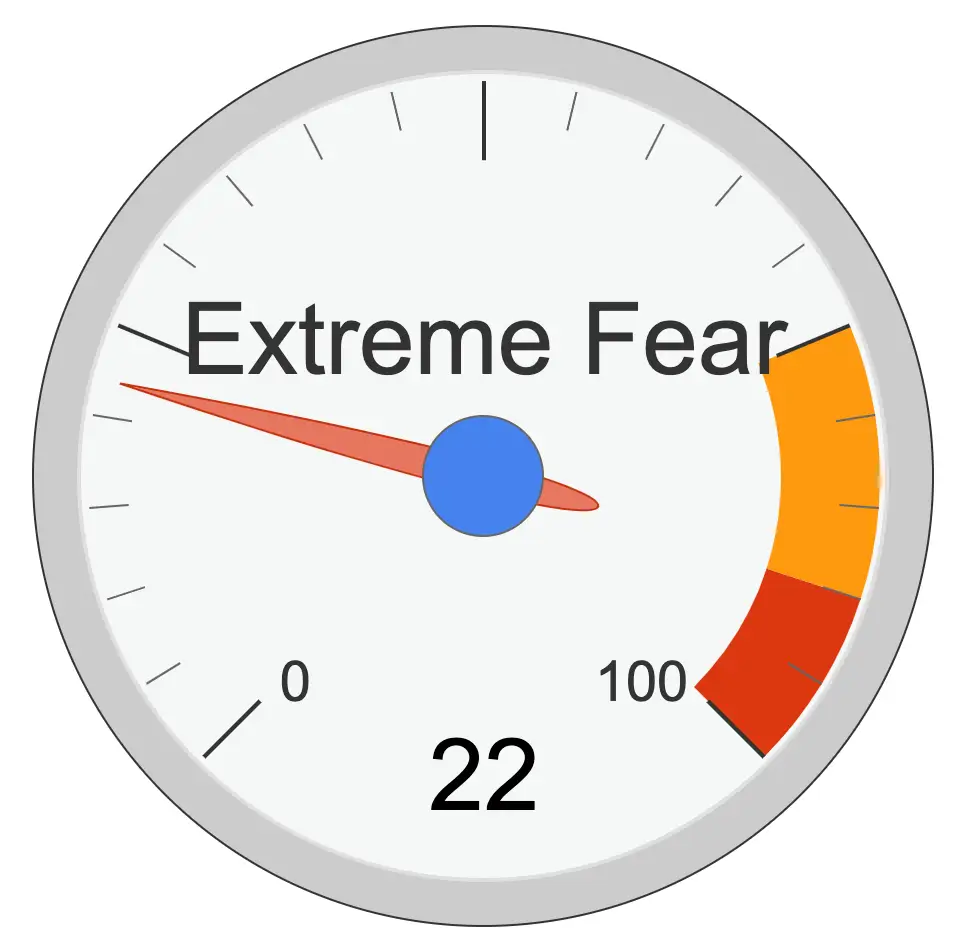

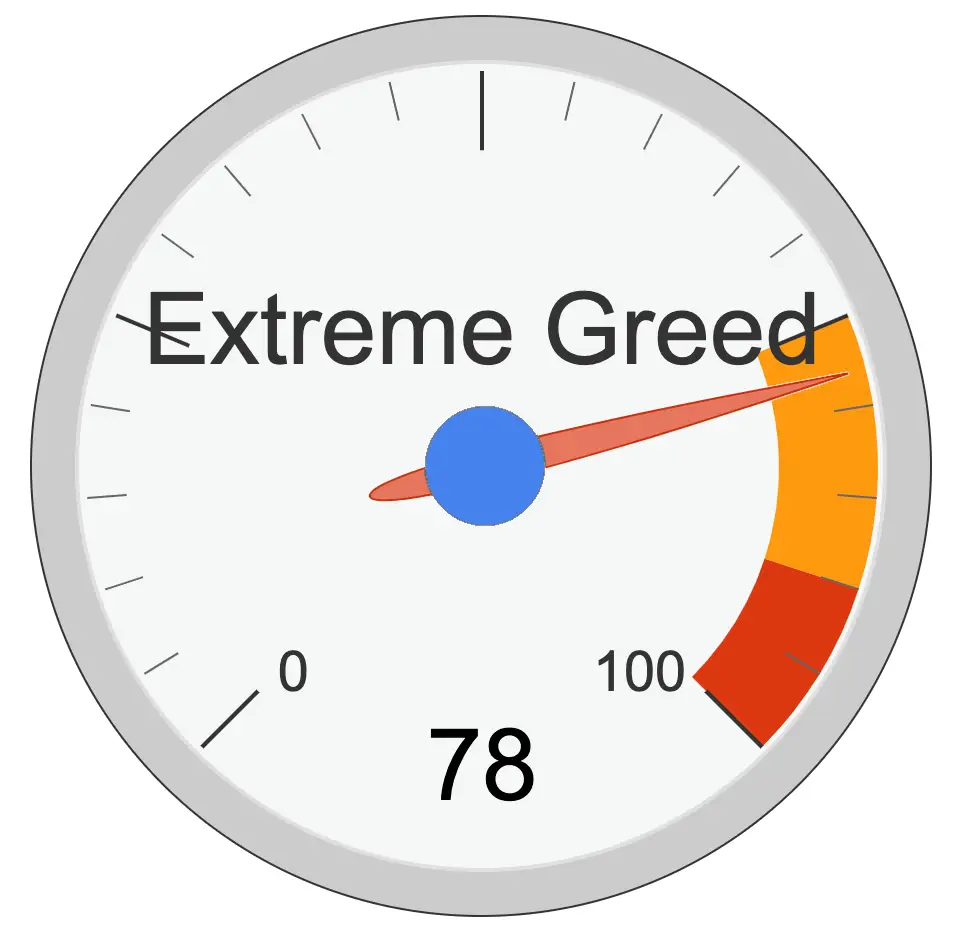

The cryptocurrency market Fear and Greed index is highly volatile, as is the crypto FGI. If you trade cryptocurrencies frequently, it might be worthwhile to monitor the index daily. The index is displayed below in the gauge meter. We update the index daily.

Bitcoin FGI index on [datetoday].

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

A higher number indicates extreme greed or greed, while a lower number indicates extreme fear or fear. You can track the index over time to better understand how it fluctuates.

If you see that the crypto price is driven by fear, you may head to your crypto trading platform and consider buying because other investors are fearful, and cryptocurrencies could sell for a lower price. On the flip side, if the crypto market is driven by greed – be careful with buying.

How do I react to extreme index levels?

When you see index levels below 25 or above 76, these are considered extreme levels, and you should pay close attention, especially if you have open positions.

Index levels below 25 – This means that investors are becoming increasingly bearish and are selling off their assets. This could be due to various reasons, such as political instability, economic uncertainty, or simply because they believe the market is due for a correction.

Index levels above 76 – This means that investors are increasingly bullish and buying up assets. This could be due to various reasons, such as positive news, technical indicators, or simply because they believe the market is due for a rally.

Saving on cryptocurrency trading fees

Timing the crypto market is impossible, and the Bitcoin fear and greed index is not a magical tool either. However, cryptocurrency trading becomes costly because of trading fees if you have to open or close positions by just guessing without additional research. You can check our reviews on top crypto trading platforms if you want to lower your trading fees and find the most suitable one.

How is Bitcoin fear and greed index calculated?

Bitcoin fear & index may appear to describe the overall fear of the cryptocurrency market, but in reality, it measures mostly Bitcoin. Nonetheless, Bitcoin generally represents what is happening and shows current sentiment. Therefore, it’s still relevant to other major cryptocurrencies like Ethereum, Solana, Cardano, Tether etc. The index uses six indicators, often derived from both qualitative and quantitative measures.

1. Volatility – 25%

Measures the current price of Bitcoin and compares it with 30 and 90-day averages. A sharp rise in volatility might mean the market is fearful.

2. Market momentum / Volume – 25%

This indicator uses a combination of current Bitcoin market volume and market momentum. It then compares it to the average of the last 30 and 90 days. A strong upward momentum may suggest a bullish market, while a strong downward momentum may suggest a bearish market.

3. Social Media – 15%

Analyzes market sentiments based on social media posts, Twitter hashtags, reactions on posts, etc. If the measured interactions increase sharply over a short period, it may be showing investor greed.

4. Dominance – 10%

This indicator measures the Bitcoin market cap share from the whole crypto market cap. An increase in market cap dominance by Bitcoin may indicate reduced speculation for other cryptocurrencies. This may represent a bearish response from the investors. Conversely, decreased dominance by BTC may indicate a rise in speculations of other cryptocurrencies, which may suggest a bullish market response.

5. Trends – 10%

The indicator looks at the Google trends data for Bitcoin and its related search terms/keywords. A rise in search volumes and recommendations from popular sites may trigger a bullish market.

6. (Discontinued) Surveys – 15%

This indicator is derived from a polling platform to see what individuals think about the markets. NOTE: This indicator has been paused. It’s no longer used in the analysis.

Crypto fear and greed index historical data

How does the cryptocurrency FGI work?

The crypto FGI calculates investor sentiments on a scale of 0 to 100. 0 represents extreme fear, where investors become overly bearish. 100 represents excessive greed leading to investors getting excessively bullish. The meter tracks market price variations daily, weekly, monthly, and yearly.

The logic is that excessive fear drives down crypto prices (Bear Run), while too much greed drives the prices up (Bull Run). The result is that most investors get greedy when the market is on the Bull Run, which results in fear of missing out (FOMO). On the other hand, people rush to sell their coins in an irrational reaction when they see prices go down.

Understanding how investors react emotionally allows intelligent investors to take advantage of the market situation by taking a logical position.

Crypto sentiment influence

Crypto sentiment analysis looks at how crypto investors feel about the market at the research time. It emerges from the sentiment analysis, which checks the user and customer demands, driven mainly by social media engagements. Are people fearful, greedy, or simply neutral?

The truth is these emotions significantly impact investors’ decisions, even though they know the importance of technical and fundamental factors. In crypto, emotions run high and take centre stage when making investment decisions. Such actions lead to extremely high price volatility, which can be stressful for those who mistime the market but offers a greater opportunity to make money if you understand people’s emotions and master your own.

Criticisms of the Bitcoin FGI

Like any other tool, the fear & greed index has faced some criticism in the face of its successful applications by investors. Critics argue that FGI is just a barometer for market timing. Instead, they encourage investors to embrace “buy and hold”. However, while some investors prefer a buy-and-hold strategy, it must be noted that day trading is part of why crypto is growing. Such traders need the Fear & Greed Index to understand the market dynamics and sentiment change.

Conclusion

Crypto FGI may look different from the original FGI indicator developed by CNN Money. However, the two indices fundamentally employ the same principle to measure investor fear and greed levels by monitoring investor emotions.

Bitcoin fear & greed index is a helpful tool for understanding market sentiments. However, it can be misleading because no tool can entirely predict the market. If they could, everyone would use them, and the results would be counterproductive. That’s why we emphasize the need to do your research to supplement these indices before buying any digital asset.

Some academic research by behavioural economists has suggested that greed can interfere with our brain’s functionality by forcing it to ignore common sense and self-control. There could be no generally accepted research on the workings of greed. However, it’s been proven that fear and greed can become extremely powerful motivators in the investment circle. It’s because most investors are emotional with money, hence reactionary in the face of either fear or greed.

The lowest Bitcoin fear and greed index is 0. However, it has never been so low. The historical lowest Bitcoin fear and greed index was 5 on the 22nd of August, 2019.