If you’re planning on buying stocks through Revolut, this review will give you all the information you need to know beforehand. You’ll learn about Revolut’s stock fees, whether they’ll affect your potential gains, and how easy it is to buy stocks on Revolut.

Revolut trading is a popular choice among beginner stock traders, but is Revolut good for stocks? I’ll explain why I think Revolut is bad for stock trading and why I prefer other trading apps.

By the end of this review, you should have a much better understanding of whether or not Revulot is right for your needs when it comes to stocks.

Revolut stock trading review

When the stock trading function was introduced on Revolut, it was prone to bugs, and there were not many stocks for investors to trade. Fast forward a few years, and the app functions smoothly, has more than 2,000 stocks and provides a great user experience.

Revolut has proven to be an easy app for European and UK investors to buy stocks from the US stock exchange. However, it’s highly likely not the main reason users chose the app, and it’s certainly not the best stock trading app in Europe yet.

Revolut brings together many features in one app, making it attractive to most users who don’t use investing as the app’s main feature.

However, Revolut has several limitations that you should be aware of if you plan to use it for stock trading.

Revolut stocks fees – Is it commission-free?

Even though the app is said to be commission-free, there are some fees you’ll need to pay even on Revolut. Some of these fees are not directly related to the Revolut app but are fees imposed on US stock trading by regulators.

These are the fees that you’ll need to pay if you buy stocks on Revolut:

| Commission/Fee | Amount & Description |

|---|---|

| Exchange fees | The trading account is in USD, so unless you hold your funds in USD on your Revolut account, you’ll need to exchange funds. Plus a 0.5% fair usage fee if you exceed the £/€1,000 exchange limit for standard and plus accounts. |

| Trading Activity Fee | $0.000119 per share with a minimum charge of $0.01 and a maximum charge of $6.49. |

| Revolut commission-free trades per account type | Standard (£/€0.00/month) – 1 trade a month Plus (£/€2.99/month) – 3 trades a month Premium (£/€7.99/month) – 5 trades a month Metal (£/€13.99/month) – 10 trades a month |

| Trading fee after exceeding the commission-free limit | 0.25% of the Order amount or the minimum of £1.00 in the UK / €1.00 in the Eurozone. |

Is Revolut stock trading cheap? It is cheap if you trade stocks rarely, but if you want to trade more often and avoid fees, you’ll need to look for another broker. Today, stock trading is cheap for most brokers and paying a monthly subscription only to get more commission-free trades is not worth it.

Revolut trading fees

Depending on your account type, you have 1, 3, 5 or unlimited commission-free monthly trades available.

When you exceed your commission-free trades, you’ll need to start paying a variable fee on each Trade thereafter. It is a 0.25% fee of the Order amount or the minimum of £1.00 in the UK / €1.00 in the Eurozone.

Is Revolut safe for stocks?

Revolut offers convenience, and a user-friendly platform for those who may not have prior experience with trading but buying stocks from a broker directly is probably a safer option. Here’s why:

- Revolut trading is a middleman, hence why it adds a redundant layer to the traditional trading process. It means traders have less control over the assets bought on the app.

- Revolut trading Ltd. stopped supporting European traders after the BREXIT due to regulatory limits. So if you’re not a UK citizen, your investments in Revolut are no longer protected by the EU deposit protection scheme. Revolut Trading Ltd. is regulated by the Financial Conduct Authority, and it covers only citizens from the UK. Revolut is slowly getting back on track with their Lithuanian banking licence, but that doesn’t include stock trading yet. You can check Revolut alternatives to find a regulated broker.

Revolut trading limits

There are some restrictions to bear in mind when using Revolut’s stocks:

- You are limited to the U.S. stock market only.

- No after-hours trading.

- You can buy stocks at a minimum of 1 USD and up to 10,000 USD in one order or up to 500 company shares. You’ll need to place another transaction order if you need to buy or sell more.

- You must always comply with Pattern Day Trading rules that restrict you to day-trade more than three times in 5 business days.

Investing with the Revolut app

Revolut investors can buy stocks from the US stock exchange only. It has more than 2,100 stocks available on the app.

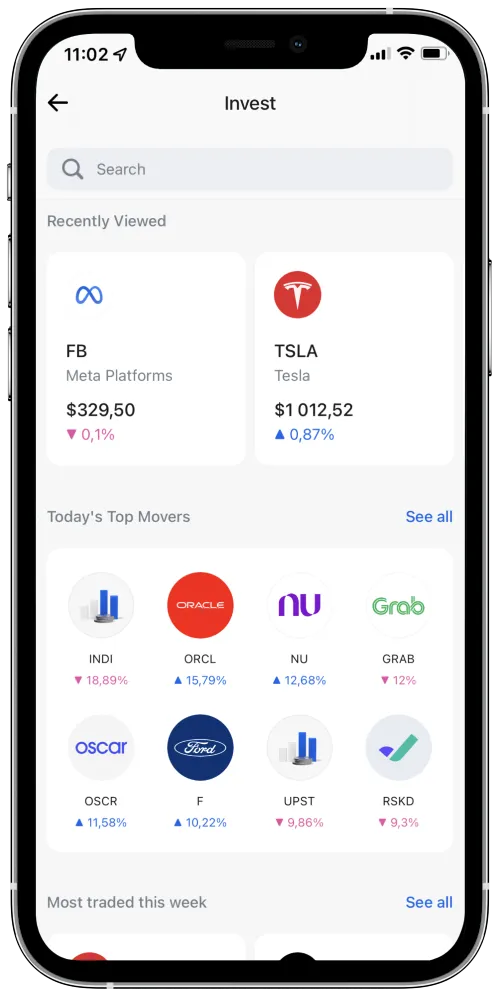

The app is user-friendly and intuitive. It has valuable features where you can follow the latest news, get essential stock data, check top movers and even evaluate your trading results.

How to buy stocks on Revolut?

Investors in countries where Revolut trading is accessible may quickly buy stocks through the app. Trading with Revolut isn’t difficult, but it’s essential to understand how things work before purchasing any stocks. You should also meet the age requirements.

Remember: Don’t invest funds you cannot afford to lose!

Before you can buy stocks on Revolut, there are a few things you must complete.

- Download and install the Revolut app – First, you need to download and install the Revolut app to access stocks. Depending on the mobile device you are using, below are the links where you can download the app:

- For Android users, download Revolut from Google Play Store.

- For iOS users, download Revolut from the Apple store.

- Create & verify your Revolut account – After installing the Revolut app on your mobile device, open the app and create your account. You’ll need to verify your identity as it’s required by the international KYC (Know your customer) and AML (Anti-money laundering) regulations. It’s a common process for financial institutions.

- Apply for a Revolut trading account – Find the Revolut Stocks tab in the app and apply for a trading account. You’ll need to go through multiple documents and e-sign them before you can get access to the trading account.

- Add funds to your Revolut account – You can top up the account by wire transfer, credit card or another method.

Buying stocks on Revolut step by step

Timed needed: 2 minutes

Investing with Revolut is simple, and you can buy stocks in almost no time. Here are the steps to buy stocks on Revolut:

- Go to the ‘Stocks’ section in the app.

Open the Revolut app and find the ‘Stocks’ tab to begin the investing process.

- Add money to your trading account

Click on ‘+Add money’ and fund your Revolut trading account with the amount you want to invest.

- Click on the ‘Invest’ button

In the ‘Stocks’ tab, click on the ‘Invest’ button to get to the company list available for investing.

- Pick a company stock you want to buy

Find a company from the Revolut stocks list you’re interested in and click on the ‘Buy’ button.

- Enter the amount you want to invest

Enter the number of stocks you want to buy or the amount you want to invest. You can also pick an order type.

- Review and confirm your order

Make sure everything is correct with your order and confirm it.

- Congratulations, that’s it!

You have just bought your first stocks on Revolut. You can see the number of stocks you own and the invested amount in your ‘Stocks’ section.

Revolut stocks quiz answers – Investing in stocks

Revolut has developed a simple course to help you learn about stocks. You can master the fundamentals of stock trading, and we suggest that you go through the lessons and gain a basic understanding of stock trading. See below for the correct answers if you need assistance with the answers.

Stocks basics – answers

How to invest in stocks – answers

How to withdraw money from Revolut stocks

If you want to withdraw funds from the Revolut trading account, you can withdraw the uninvested amount at any time. If you have just sold any stocks in the app, you’ll have to wait until the sale order settles and the money becomes available. It usually takes about two days.

Revolut stocks summary

Revolut stock trading is not a good platform for active stock traders, due to trading limits and fees. There are better stock trading alternatives that specialise in stocks and offer more benefits, such as regulatory protections, features and asset variety.

If you choose to trade stocks on Revolut, try to operate with your funds within working days to avoid overpriced forex rates. Bear in mind that, if you’re not from the UK, changes associated with BREXIT strip the benefit of any EU regulatory protections or investor compensation schemes.

To close your trading account, you must ensure you no longer own any company shares. Withdraw all the funds from your Revolut ‘Stocks’ account and click on the three dots where is the ‘Close trading account’ button.

You can make money on Revolut trading by buying and selling publicly traded company stocks. To make money, you need to sell stocks at a higher price than you have bought. Please note – your capital is at risk, and there’s no guarantee that you will earn from your trades.

No, but you can place a trading order before or after the market closes. The order will be executed once the market opens again.

Revolut Trading Ltd. is an appointed representative of Resolution Compliance Ltd, which is regulated by the Financial Conduct Authority (FCA) in the UK. Revolut Trading Ltd. is not regulated in Europe.

Revolut stock market opens at the same time as the US stock market, from Monday to Friday, 9:30 am to 4 pm EST.

Yes, Revolut allows stock trading but you should stay within day trading limits – three times in 5 business days.

No, there are fees associated with stock trading on Revolut. These fees vary depending on the account type and your stock trading frequency.

If you encounter a problem where Revolut stock trading is not available, you either don’t meet the age requirements or Revolut trading is not available in your country.

Yes, it’s possible to buy fractional shares, which means that if the company share you want to buy is worth $1,000 per share and you can only afford to invest $500, you can buy half of the company share and still participate with your investment and gain profit if the company stock price increases.

I also took a step in to the stock market because of Revolut when they launched the possibility.

It is so simple and also easy to check/buy/sell.

On the other hand my stocks are blocked, yess I’m one of those EU customers. I know I have could “cash-out” at 31 December ’20 but the markets where at that point not so good and I choose the risk to wait until they get their EU trading license later 2021.

And hope in couple of months they are active again in the EU and by then pandemic is under control and stocks markets thrive again.

I have started to enjoy investing in stocks and shares on revolt and I have gained some knowledge in this regard, I have upgraded to a metal account and this provides me with my needs as a small investor and I have enjoyed the app and the information in the way its relayed to the screen.