Those days when cryptocurrencies were just an unknown slang used by some computer nerds are long gone. Today, it’s a volatile but valuable asset to many professional and beginner investors. So, if you’re just a beginner and want to start investing in cryptocurrencies but don’t know how and where to begin, we’ll clear that out and show you how to do it step by step.

First, you need to understand what cryptocurrencies are and how investors can make money on cryptocurrencies so that you can begin with the most suitable option for you. Let’s start!

What is a cryptocurrency?

Cryptocurrency is a virtual or digital currency based on blockchain technology. It means that you can’t physically touch it as you may be used to with your local currency in the form of paper or coins issued by a government (known as FIAT money).

What are cryptocurrencies used for?

Cryptocurrencies serve the same purpose to help to exchange digital currency or cryptos for goods or services. The most significant difference is that cryptocurrencies don’t require any centralised institution management, i.e. banks or governments, and it doesn’t require an intermediary for a transaction.

Central banks regulate the amount of money in circulation, which is a problem when the bank decides to issue more money causing inflation in the market. In contrast, cryptocurrencies don’t require banks’ involvement in the transaction process. Transactions are verified and stored in a database on an extensive network of computers. Many computers worldwide support the crypto network, and it’s nearly impossible to intervene or hack it. These computers have the same transaction information, and none individually run the network, which is why it’s a decentralised solution.

What is Bitcoin?

Because of the financial market crash in 2007-2008, developing a better financial system was essential. And even more critical – developing an independent system. So, Bitcoin was invented, and the main idea was to serve as an electronic peer-to-peer cash system without an intermediary. It was essential to replace the current financial system controlled by banks and governments to avoid a similar financial market crash in the future.

Today, there are multiple types of cryptocurrencies; however, the first and the most popular cryptocurrency is Bitcoin. With Bitcoin, the invented technology solved the double-spending problem in a decentralised way for the first time. See how to buy Bitcoin.

Avoiding a double-spending problem, where you could spend the same amount twice, was critical. It allowed to creation of a cryptocurrency and hit the market for the first time. Now, it works as an independent system without an intermediary.

How to start investing in cryptocurrency?

The rapid increase in popularity has opened many opportunities for investors to jump into the crypto space and earn from price fluctuations. Prices of cryptos are determined based on supply and demand, which is why investors who have entered the market earlier may have gained more profit today.

We believe the popularity has not reached its peak, and there are still many opportunities before it becomes mainstream.

There’s more than one way to invest in cryptocurrencies; some are more speculative, some more technical. To start investing in cryptocurrency, you should pick the best investment type that suits your risk appetite.

The most popular and easiest methods to invest in cryptocurrencies are: cryptocurrency trading and investing and holding (hold). However, remember that cryptocurrency prices can also decrease in value.

Cryptocurrency trading

Since cryptocurrency prices are highly volatile, it allows traders to make a profit on rapid price changes. They are profiting from the asset price difference.

The best thing about crypto trading is that by correctly predicting the direction of an asset’s price fluctuations, with some brokers, it’s possible to gain from both: rising and falling prices.

If you’re a beginner and don’t know how to begin or don’t have enough time to trade daily, you may consider crypto copy trading from professional traders on eToro.

Best for investors who:

- Want to gain profit from price fluctuations.

- Don’t want to deal with cryptocurrency security risks.

- Don’t fully understand the technology and are not technical.

Buying and holding cryptocurrencies

Buying and holding cryptocurrencies is the most common type of cryptocurrency investing. However, there are some downsides, and it may require additional hardware to store your cryptocurrencies (I.e. an external crypto wallet).

There’s also no possibility of making money when crypto prices decrease. The profit is made from the price differences at the time of selling.

Best for investors who:

- Understand the technical side of cryptocurrencies.

- Want to buy and hold cryptos in the long term.

- Want to support a particular cryptocurrency growth and concept.

- Understand and can take care of the security risks associated with cryptocurrency holding.

Different types of cryptocurrency investing

Even though there are multiple ways to make money with cryptocurrencies, most require an actual crypto asset acquisition. Here are some of the most popular alternative cryptocurrency investment types.

- Cryptocurrency mining – Blockchain technology requires a network of computers to validate and verify transactions to solve a complex mathematical puzzle and record transactions in the blockchain.

This is where miners come in with their computer power. I.e. Cryptocurrency miners set up a computer for Bitcoin mining, and in exchange, they receive a small reward in the form of Bitcoin. It’s a technical process and requires specific knowledge. Best for advanced investors. - Cryptocurrency staking – Investors can earn additional income by staking crypto coins. I.e. Ethereum, Cardano and Tron – all support cryptocurrency staking. Staking is a way of earning interest by holding specific cryptocurrencies. Best for beginner to advanced investors.

- Cryptocurrency dividends – It is already said in the name itself. Similarly, as in the stock market, some cryptocurrencies offer dividends to their investors, I.e. NEO. Best for beginner to professional investors.

These are the most common ways to earn from cryptocurrencies. Each requires a different set of knowledge, budget and time commitment.

Cryptocurrency trading and buying/holding are the most popular methods, so below, we will take a closer look at where and how to begin cryptocurrency trading. You can buy and hold on the same platform if you prefer.

How to invest in cryptocurrencies?

To begin investing in cryptocurrencies, you must have reached the age limit and should have sufficient savings.

Once you’ve determined that is the case, you can start by researching different cryptocurrencies and selecting the most profitable ones. You may focus on just one cryptocurrency or keep tabs on several at once.

Here are 5 simple steps to begin investing in cryptocurrencies:

- Find a cryptocurrency exchange or trading platform.

- Create an account.

- Verify your identity.

- Deposit at least the minimum amount.

- Buy a cryptocurrency of your choice.

Where to invest in cryptocurrencies?

To begin trading cryptocurrencies, you’ll need to find a crypto trading platform or exchange that fits your needs. Also, not all exchanges accept users from every country. You should be able to determine the requirements during the account setup process.

How to choose a crypto trading platform or app?

Understanding the basic features and major differences when choosing a crypto platform is crucial. However, finding a good crypto trading platform is crucial. This guide aims to help you understand the standard features and differences between crypto trading platforms to decide which one is best for you.

One of a crypto trading platform’s most important features is security. You should pay attention if the platform has

- two-factor authentication,

- multi-signature transactions,

- and advanced encryption technology.

In addition, some platforms offer a robust user interface that makes it easy to navigate and use.

Another major factor to consider when choosing a crypto trading platform is the range of supported cryptocurrencies. Some platforms offer a wide variety of coins and tokens, while others specialize in specific cryptocurrencies.

Finally, it’s essential to consider the fees charged by different platforms. Generally speaking, most platforms charge low fees for transactions; however, some may have higher fees for specific features or services.

If you are looking for a reliable crypto trading platform, research and consider these important factors. Whether you are a beginner or an experienced trader, there is a platform out there that will meet your needs.

Popular crypto trading platforms

One of the most popular choices for crypto trading today is eToro. It has a long and trusted history in the market, proving to be a reliable platform even in uncertain times. There are many features for learning, and traders can interact with each other because the platform offers a social trading feature. The best part is that beginners can test the platform and simulate the trading process and features in the practice account, which is accessible to all eToro users.

Best for

International & European investors

Crypto buying fee

1.00%

Demo account

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

How to buy cryptocurrencies – Step-by-Step

There are many different types of cryptocurrencies, but the most popular one is Bitcoin. So in this example, we’ll focus on Bitcoin.

To buy cryptocurrencies, you’ll need to follow a few simple steps. For example, we’ll use the eToro platform, which is highly trusted in the industry and has high-security standards.

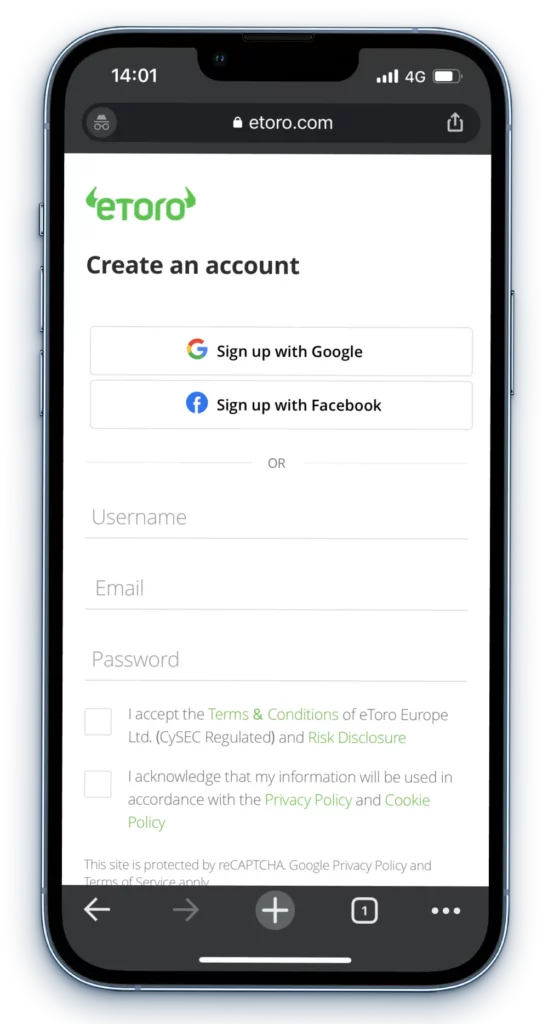

- Sign up for an account

Before getting access to the platform, you need to create an account on eToro. This is where you will buy and store your cryptocurrencies.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

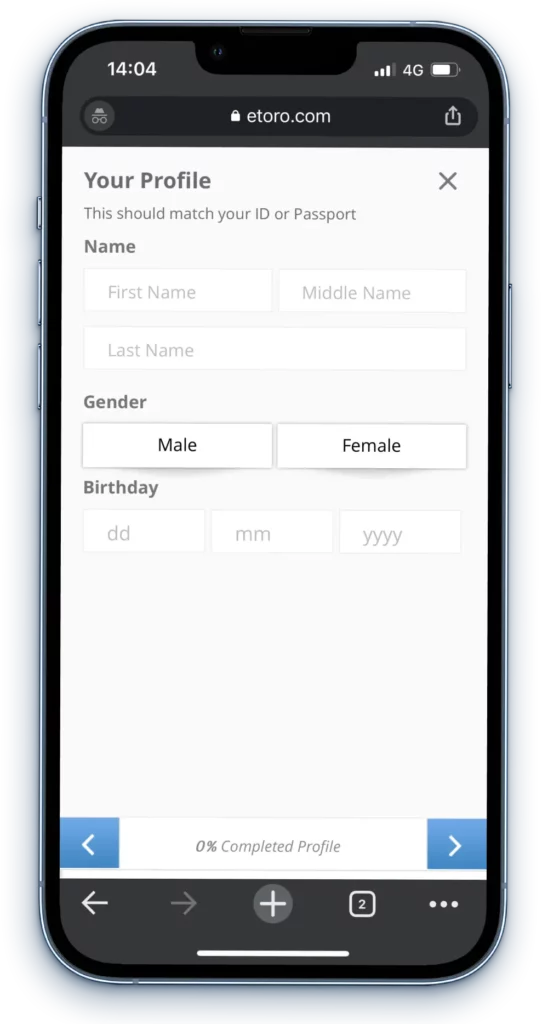

- Verify your account and identity

You will be asked to verify your email address, identity etc. There are specific regulations that require financial institutions to check their users. It’s a standard procedure.

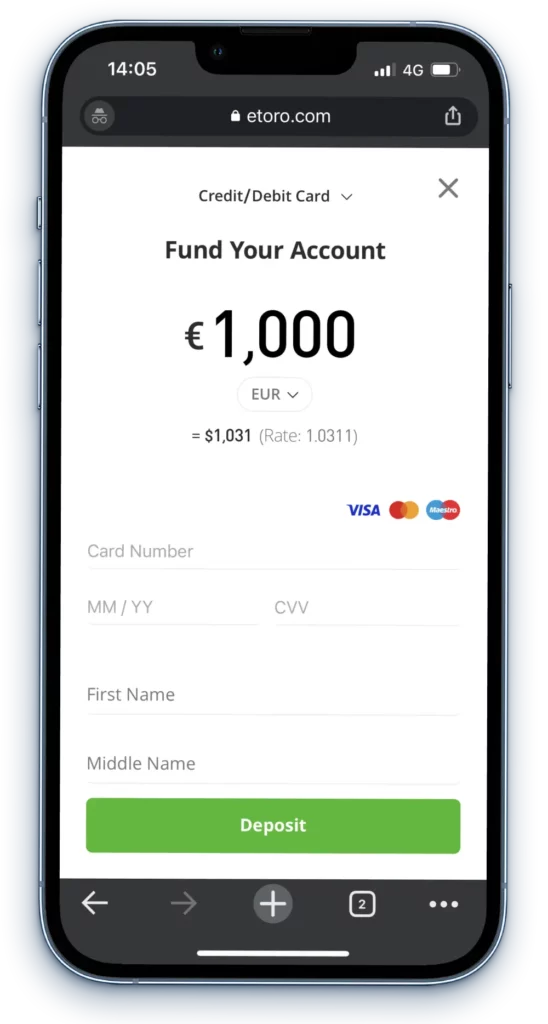

- Deposit funds into your account

Deposit at least the minimum required amount. Starts from $50 USD and varies across the countries, for the UK users it is $100 USD.

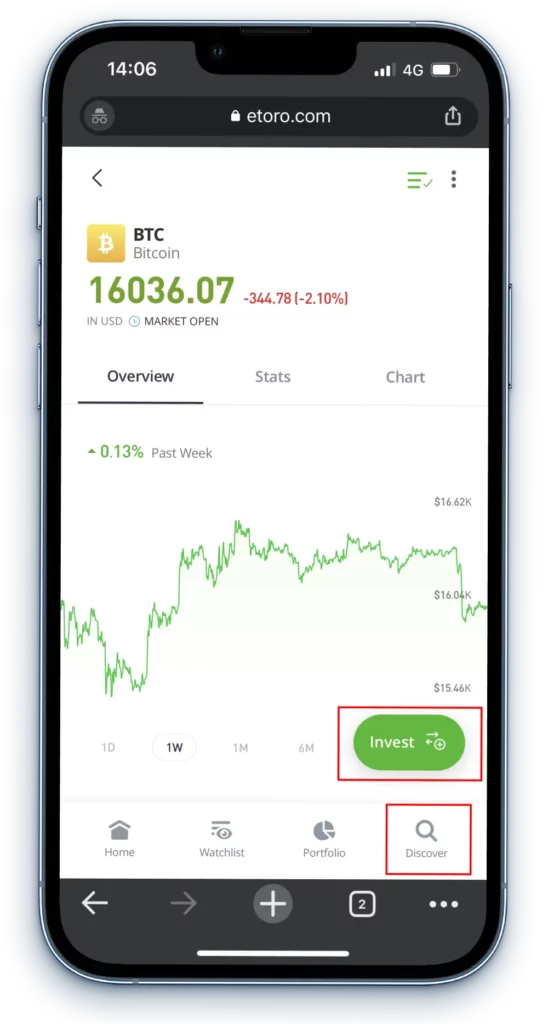

- Pick a Cryptocurrency

Find a cryptocurrency you want to buy by using the internal search function. In our example, we’ll buy Bitcoin.

- Invest in the cryptocurrency of your choice

Once you pick the cryptocurrency, enter the amount and confirm your purchase. Don’t worry if the cryptocurrency of your choice costs more than you have in your account. You can buy a fraction of the cryptocurrency as well.

Which cryptocurrencies to buy?

Well, there are several cryptocurrencies out there, but predicting which one is the best for investing is not an easy task.

- Penny cryptocurrencies – These are the smaller cryptocurrencies that typically have a very low market cap and price. While these may not seem like suitable investments at first, they can sometimes offer significant returns if the coin can gain more popularity or if another cryptocurrency increases in value.

- New cryptocurrencies – Another option is to invest in newer cryptocurrencies, which may not have much value yet but could potentially deliver high returns as they grow in popularity.

- Most popular cryptocurrencies – The most popular cryptocurrencies, such as Bitcoin and Ethereum, have typically been great choices for investors due to their high market caps and ongoing growth.

- Most searched cryptocurrencies – Finally, it’s sometimes valuable to look at the cryptocurrencies that are getting the most searches online. This can help you identify trends and determine which coins may be worth investing in for the future.

In summary, there are several factors to consider when choosing a cryptocurrency to invest in, including whether it’s a newer or more established coin and its potential growth potential and popularity. With careful research and consideration, you can find the right cryptocurrency.

Should you invest in cryptocurrencies?

Often a financial analyst will say that the stock market is fundamentally sound and thus worth investing in. However, cryptocurrencies may follow a different trend than traditional stocks since they are decentralized and unregulated by any central authority.

As of now, there are thousands of different cryptocurrencies, but not all of them are worth investing in. Before investing your own money, you consider the high risk that comes with cryptocurrency trading. The crypto market is highly volatile, and so are the prices of cryptocurrencies.

If you want to know if it’s the right time to invest in the cryptocurrency market, you can learn more about the cryptocurrency fear and greed index, which is a great tool for understanding the crypto market sentiment.

Conclusion

As you can see, investing in cryptocurrency is not rocket science. It’s quite simple and accessible to everyone. The main task when investing is always to learn more and research the market to find good investment opportunities. Most people are often waiting for the right time to invest. Still, it’s impossible to predict the lows and highs of the market, so investing in smaller amounts consistently can often yield better results and average out the cryptocurrency price to gain profit in the long term.

A rule of thumb is never to invest the money you cannot afford to lose.