Use this free 50/30/20 budget calculator to instantly divide your income into needs, wants, and savings – and finally know where your money should be going.

This calculator follows the proven 50/30/20 rule, a simple budgeting method that helps you:

- Cover essentials without stress

- Spend guilt-free on things you enjoy

- Build savings automatically

Whether you’re budgeting for the first time or fixing a broken system, this tool gives you clarity in minutes.

If you want to save your budget plan in the excel file, you can skip to the 50 30 20 budget excel template.

50/30/20 Budget Calculator

Use the 50/30/20 rule to estimate a practical split between essentials, lifestyle spending, and savings based on your net income.

Income after tax and mandatory deductions

Recommended allocation

How the 50/30/20 Budget Calculator Works

This budget calculator based on income does the math for you so you don’t guess or overthink.

Step 1: Enter Your After-Tax Income

Use the amount that actually hits your bank account – not your gross salary.

Step 2: Automatic Allocation

The calculator instantly splits your income into:

- Needs (50%)

- Wants (30%)

- Savings (20%)

Step 3: Reality Check

Compare the results to your current spending.

If one category is off, you’ll know exactly where to adjust.

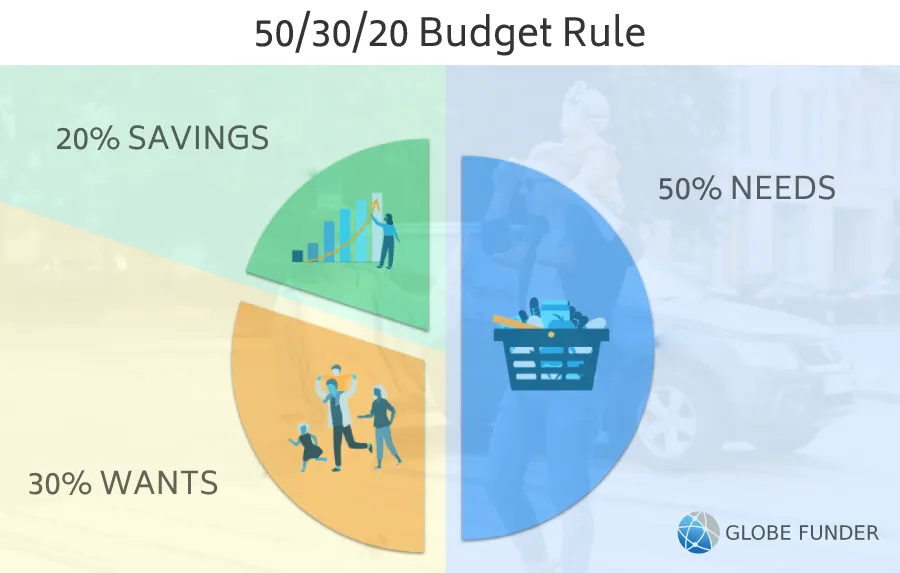

What Is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting method that divides your after-tax income into three categories:

- 50% Needs – essential living expenses

- 30% Wants – lifestyle and discretionary spending

- 20% Savings – future-focused money goals

The rule was popularised by Elizabeth Warren and has since become one of the most widely used personal finance frameworks because it balances discipline and freedom.

The Formula

After-tax income × 50% = Needs

After-tax income × 30% = Wants

After-tax income × 20% = Savings

Unlike rigid budgets, the 50/30/20 method works because it’s:

- Easy to understand

- Flexible across income levels

- Sustainable long term

“Save money and money will save you!”

What is a monthly after-tax income?

After-tax income (also known as monthly take-home pay) is the total amount of money an individual has left after all taxes have been deducted from their paycheck. This includes federal, state, and local taxes. Monthly after-tax income can fluctuate depending on the amount of money an individual makes and the tax bracket they are in.

It’s important to know what your income is so that you can budget accordingly and make sure that you are not overspending. Several online calculators can help you to determine your after-tax income.

Needs vs Wants vs Savings

Most budgeting fails because people misclassify expenses. So lets go through them one by one.

50 30 20 rule – budget categories

The basic principle is to spread your after-tax income into three categories: 50% on needs, 30% on wants and 20% on savings. Many people worry about where they spend money and whether they do it right. It’s great peace of mind if you’ve taken care of your financial obligations and savings beforehand because you know how much and what you can afford. Let’s take a closer look at each category and what comes in it.

Needs budget – 50%

“Needs” is the biggest category of all. These are your obligations and absolute necessities:

- Mortgage (The minimum monthly payment)

- Rent

- Utilities (Electricity, gas, repairs, trash, etc.)

- Insurance (House insurance, personal insurance, car insurance, etc.)

- Groceries (Food, hygiene products etc.)

- Transportation

- Phone bills

- Loans (I.e. Study loans, car loans, etc.)

- Childcare

- Healthcare

- Etc.

Wants budget – 30%

The coolest part of your budget. This part goes to pleasure, hobbies, style, beauty etc. However, don’t go crazy and remember, that more money doesn’t necessarily mean that you have to spend it all. Personal spending can also be done smartly.

Here are some examples:

- Clothes

- Improvements (Better phone, furniture, house improvements, etc.)

- Dining out (Restaurants, cafes, fast food, etc.)

- Gifts

- Charity

- Movies

- Gym memberships

- Vacations

- Better lifestyle

- Shopping

- Etc.

Savings budget – 20%

This budget takes care of your future and provides you with peace of mind in case of emergencies. A proper savings plan often helps people achieve financial independence and allow them to retire early. If you plan your savings early, you may realise that in 15 years or even less, your passive income surpasses your income from your day job. Of course, it all depends on individual circumstances.

Savings and debt repayment are both important for financial stability. Savings act as a cushion to cover unexpected expenses or a loss of income, and they can also earn interest over time.

On the other hand, debt repayment helps reduce the amount of interest you pay on loans and can improve your credit score. Both savings and debt repayment are important pieces of financial planning.

Even if you have a low monthly income and a loan (or multiple loans), interest payments can add up and reduce your purchasing power. So, if you plan your living expenses, know your net income and avoid overspending, you can be smart about your budget and make a big difference in your future with little steps, even by just increasing your minimum debt repayments where possible.

Here are some examples of savings:

- Emergency fund

- Extra debt payments (I.e. Paying an additional amount of mortgage than a monthly minimum)

- Bank savings

- Mutual funds

- Stock markets (I.e. Buying stocks on Revolut)

- P2P investing

- Crypto investments

- Individual retirement account (IRA) contributions

- 401k contributions

- Etc.

50/30/20 Budget example

Once you spread your income in three ways, you’ll feel safer, more stable and in balance with your financial decisions. Here’s an example of how would look like a 50/30/20 budget for a family of 2 parents and a child:

- Let’s assume that both parents make around 4,000 EUR or USD a month after-tax.

- The family already has an emergency fund worth 6,000 EUR or USD.

- This means that the desired distribution of money would be: Needs – 2,000, Wants – 1,200 and Savings 800.

| Type | Amount | Percentage of total income |

|---|---|---|

| Mortgage Payment | 380 | 9,50% |

| Utilities | 150 | 3,75% |

| Groceries | 400 | 10,00% |

| Childcare | 350 | 8,75% |

| Insurance | 90 | 2,25% |

| Transport | 250 | 6,25% |

| Accounting | 60 | 1,50% |

| Education | 120 | 3,00% |

| Healthcare | 80 | 2,00% |

| Phone & Internet | 45 | 1,13% |

| Total in the ‘Needs’ category: | 1,925 | 48,13% (50% max.) |

| Type | Amount | Percentage of total income |

|---|---|---|

| Dining out | 160 | 4,00% |

| Entertainment & Hobbies | 170 | 4,25% |

| Gifts | 100 | 2,50% |

| Travelling | 200 | 5,00% |

| House improvements | 70 | 1,75% |

| Clothing | 160 | 4,00% |

| Memberships | 25 | 0,63% |

| Other expenses | 50 | 1,25% |

| Total in the ‘Wants’ category: | 935 | 23,38% (30% max.) |

| Type | Amount | Percentage of total income |

|---|---|---|

| Extra mortgage payments | 250 | 6,25% |

| Stock markets | 350 | 8,75% |

| P2P investments | 200 | 5,00% |

| Total in Savings category: | 800 | 20,00% (20% max.) |

You will have your own expenses. However, some of them may overlap with yours. These are just examples of how it could look in the end. In the example above, you can see that there’s some money left after all the expenses. The family spends 3,660 (Euro or Dollars) per month, and it’s 91,50% of all the income. It’s up to you to decide whether you want to contribute more to your savings account or maybe put it aside for a trip. The main thing is that you deduct your regular expenses and savings once you receive your payment right away.

50/30/20 Budget excel spreadsheet template

If you’re done playing with numbers in our calculator above and want to make things serious, start a budget with the 50-20-30 rule in the excel template below. Feel free to edit as you wish and save it for personal use. Both 50/30/20 budget excel templates have the same features and offer a more in-depth analysis of your expense categories. These excel templates will help you understand your daily spending and see an excel budget spreadsheet with percentages. Have fun!

50/30/20 Budget Template in PDF

If you prefer to plan your budget on paper, you can download the 50 30 20 budget template in the pdf format below:

Quick tips on budgeting

- Try to allocate each spending category to separate accounts to make it easier to keep track of your funds.

- If you don’t have an emergency fund, make sure to create one. A good rule of thumb is that it should cover at least three months of your needs. If it’s less than that or you had an emergency, top up the emergency fund before turning back on investments or other savings.

- Use the 50/30/20 budget calculator on all of your income, i.e. when you sell some of your old stuff or get a bonus at work. Save the tool as a bookmark so that you can easily access it when you receive your next payment and you need to budget it.

- After some time, you’ll start seeing patterns in your finances and where to save on costs.

It’s a budgeting method that divides after-tax income into needs (50%), wants (30%), and savings (20%).

In short, spread your after-tax income into 3 main categories, Needs – (i.e. Mortgage, rent, insurance, health, groceries etc.), Wants – (i.e. Clothes, entertainment, house improvements, travelling, etc.) and Savings – (i.e. Investments in stocks, extra mortgage payments, etc.).

Yes – as a framework. Start smaller on savings and scale up.

If you find yourself in a situation where you can’t afford to put off 20% of your income, try to adjust the model to a smaller percentage in the beginning. I.e. At least 5%. And try to look at this model as a goal you need to achieve. Once you achieve it, try to stick to it as long as possible.

Perfect, it means that you may have months where your income is higher than you need and vice versa. Just use this calculator for each payment you receive and stick to the model if you can.

Absolutely. The rule is flexible and should adapt to your life.

Perfect, thanks a lot for the 50-30-20 excel spreadsheet! I was looking for a good template to use for my monthly budget planning since I tend to overspend almost every month.

I need to get into a better financial shape this year!